Company Registration Services by PG Bansals

Introduction to Company Registration

PG Bansal and Associates offer seamless company registration services for Indian nationals seeking to establish their businesses in India. Whether you’re a first-time entrepreneur or expanding an existing business, our services ensure a smooth and compliant process to incorporate your company.

Private Limited (Pvt Ltd) Company Registration

WHAT IS PRIVATE LIMITED COMPANY REGISTRATION?

PG Bansal and Associates offer seamless company registration services for Indian nationals seeking to establish their businesses in India. Whether you’re a first-time entrepreneur or expanding an existing business, our services ensure a smooth and compliant process to incorporate your company.

Private Limited Company is the most favoured form of business entity in India having perpetual succession with least of two directors & shareholders, the maximum being 15 and 50 respectively, is a must for private limited company registration. It is very convenient to organize and operate a private limited company as a business and can be commenced immediately. There is no minimum paid-up capital required to start a company. It also increases the credibility of the business thus, enhancing the future growth of the company.

Many start-ups and companies consider this form of a business entity as it permits capital funding to be raised easily; it also limits the liability protection to its shareholders and enables them to offer employee stock options to motivate their employees. Availability through a bank loan, equity or debt funding makes a private limited company the most recommended legal structure of many small and medium-sized business entities that are family-owned or professionally run in India.

REASONS TO OPT FOR A PLC

LIMITED LIABILITY

After establishing a private limited company registration in Mumbai, if debts are not repaid then only the invested capital in commencing the business would be lost, the personal properties of the directors would be safe unlike in a Partnership firm, where partners are personally liable for all their debts and would also have to sell their personal assets. A private limited company has a separate legal identity with restricted liability.

PERPETUAL SUCCESSION

A Private Limited Company is a business entity having perpetual succession that means continued existence until it is legally dissolved or wound up. After getting a PVT LTD company registration, it has a separate legal identity. It is unaffected by the death or removal of any Director. Thus, a Private Limited Company continues to exist irrespective of the changes made in ownership.

EASY TRANSFERABILITY

The ownership in a Private Limited Company can be easily transferred to another person by shares. The signing and filing of the share transfer form and share certificates are sufficient to transfer ownership of the company. The consent of other shareholders is required to affect the share transfers in a private limited company.

BORROWING CAPACITY

After getting a Pvt ltd company registration in Mumbai companies can raise equity funds.

With the permission of RBI, it can also issue equity shares, preference shares, debentures and accept deposits. Banks and Financial Institutions prefer providing funding to a company than partnership firms or proprietary concerns. A private limited partnership restricts its ownership but offers legal protection to its shareholders. It is relatively convenient to manage and run the company with a possibility of expansion for growing companies. It is also easier to dissolve and wind up the company.

One Person Company Registration

Limited Liability

- Owners and shareholders are not personally liable for the company’s debts or losses.

- Personal assets are protected in case of legal challenges or financial difficulties.

Legal Recognition

- Company registration provides legal recognition to the business.

- Establishes credibility and trust with clients, partners, and investors.

Ease in Raising Capital

- Registered companies can attract equity investments or loans more easily.

- Helps to expand operations and scale the business.

Perpetual Succession

- A company continues to exist even if its founders or directors change.

- Ensures long-term stability and credibility in the market.

Tax Benefits

- Companies are eligible for various tax deductions and exemptions.

- Section 8 companies (non-profits) enjoy special tax incentives.

REASONS TO OPT FOR A OPC

SOLE DIRECTOR

One Person Company is the only business venture that can be started, managed and operated by a single director/promoter with limited liability. A corporate form of legal entity ensures that the OPC has simple ownership transferability and perpetual existence.

LIMITED LIABILITY

The directors’ personal assets are always safe irrespective of the debts of the business.

PERPETUAL EXISTENCE

Sole Proprietorships dissolve only with the death of the director. But, OPC being a separate legal entity, would continue to exist due to the nominee director.

CREDIBILITY

OPC must have its books audited annually. The Credibility among vendors and lending institutions is greater because Banks and Financial Institutions prefer providing funding to a company than partnership firms.

SALIENT FEATURES

- Annual General Meeting is not required.

- Preparation of the cash flow statement is not required.

- One board meeting must be conducted in each half of the calendar year with a minimum of 90 days between two board meetings.

- OPC can be incorporated as a private limited company only.

- Section 98, Sections 100 to 111 (inclusive), shall not apply to a One Person Company and is thus, exempted from the following;

- Power of Tribunal to call meetings of members. [Section 98].

- Calling of the extraordinary general meeting. [Section 100].

- Notice of meeting. [Section 101].

- Statement to be annexed to notice. [Section 102].

- Quorum for meetings. [Section 103].

- Chairman of meetings. [Section 104].[Section 105].

- Restriction on voting rights. [Section 106].

- Voting by show of hands. [Section 107].

- Voting through electronic means. [Section 108].

- Demand for the poll. [Section 109].

- Postal ballot. [Section 110].

- Circulation of members’ resolution. [Section 111].

Public Limited Company

Meaning of Public Limited Company

According to the Company Act 2013, a Public Limited Company refers to the company which can offer shares to the public and has defined liability.

A public limited company can offer its shares to the public either via (IPO) initial public offering or trading platform like the stock market. Everyone is allowed to acquire the shares offered by PLC.

A Public Limited Company rigidly adheres to the regulations and reveals its accurate financial status to its shareholders.

Suitability & Popularity

A public company is suitable for medium and large-sized businesses that want to raise equity capital from the public. Due to its various advantages, the public limited company is one of the most popular legal entities among medium and large-size companies in India.

Characteristics of Public Limited Company

Understand the concept of PLC better, let us check its characteristics which are as follows: Let us have a look at the benefits of establishing a public limited company.

- Directors: Under Companies Act, 2013 provisions, a public limited company must have at least 3 directors.

- Paid-up capital: No minimum capital is required to form a Public Limited Company

- Prospectus Under the Companies Act, 2013: A public limited company must issue a prospectus that showcases the company’s business affairs, to the public.

- Name As per Companies Act, 2013: It is mandatory for all the public companies to end their name with the word “Limited”.

- Limited Liability Public: Limited Company limits the liability of each shareholder by making the owners jointly & severally liable for the business’s debts.

Benefits of Public Limited Company Registration

- Additional Capital Shares offered to the common public in large, allowing everyone to invest in the company, bring additional capital for the company.

- Increased Popularity Listing on a stock market platform increases the popularity of the PLC’s business among the traders dealing in mutual funds, hedge funds, etc which further opens up avenues for business opportunities for the Company.

- Divided Risk The risk of the market gets divided with the allotment of shares among the general public in large.

- Success and Business Expansion: Divided risk, increased publicity and additional capital together lead to the opportunities for business expansion & success and investment in new profitable projects.

Advantages

- Limited Liability Protection

- Better image & credibility

- Easy to raise funds and loans

- Listing on Stock Exchanges

- Favorite Business structure for Investors

Minimum Requirements

- Minimum Three Directors

- Minimum Seven Members

- Maximum Fifteen Directors

- One Director shall be Indian resident

Requirements for the Incorporation Public Limited Company

Companies Act, 2013 has listed the following requirements for the incorporation of a Public Limited company

- Minimum 3 Director and 7 Members: Minimum 3 Directors and 7 Members are required to incorporate Public Limited Company.

- PAN Card: Self-attested PAN Card of Members and Directors.

- Identity Proof of Directors: Self-attested ID proof of Members and Directors- (Anyone out of the following -Valid Passport/Voter ID/Aadhar Card/Valid Driving License)

- Address Proof: Self attested Address proof of the Members and Directors (Any one out of the following – Bank Statement/ Electricity Bill/ Telephone Bill/ Mobile Bill which and it should be not older than 2 months

- Passport Size Photo 2-2 Passport Size Colored Photos of Members and Directors.

- Business Address Proof (Owned/Rent/Leased): NOC from the Owner of Property/Property Papers (Title Deed)/Utility Bill (Either Electricity Bill or Mobile Bill or Telephone Bill) (Should Not be Older than 2 Months)

Limited Liability Partnership

What Is a Limited Liability Partnership (LLP)?

An LLP is a limited liability partnership where each partner has limited personal liability for the debts or claims of the partnership. Partners of an LLP aren’t held responsible for the acts of other partners.

A limited liability partnership (LLP) is a flexible legal and tax entity where every partner has a limited personal liability for the debts or claims of the partnership.

Partners of an LLP can benefit from economies of scale by working together while also reducing their liability for the actions of other partners. As with any legal entity, it is important that you check the laws in your nation (and your state) before making decisions. In short, check with a lawyer first. The chances are good that they have firsthand experience with an LLP.

Key Takeaways

- Limited liability partnerships (LLPs) allow for a partnership structure where each partner’s liabilities are limited to the amount they put into the business.

- Having business partners means spreading risk, leveraging individual skills and expertise, and establishing a division of labor.

- Limited liability means that if the partnership fails, then creditors cannot go after a partner’s personal assets or income.

- LLPs are common in professional businesses like law firms, accounting firms, medical practices, and wealth management companies.

Understanding a Limited Liability Partnership (LLP)

To understand an LLP, it is best to start with the general partnership. A general partnership is a for-profit entity that is created by a mutual understanding between two or more parties. This is a very technical way of describing two or more people working together to make money. A general partnership can be quite informal. All it takes is a shared interest, perhaps a written contract (though not necessarily), and a handshake.

Of course, with the informal nature of a general partnership, there is a downside. The most obvious risk is that of legal liability. In a general partnership, all partners share liability for any issue that may arise.

For example, if Joan and Ted are partners in a cupcake venture and a bad batch results in people getting sick, then they can both be personally sued for damages. For this reason, many people quickly turn general partnerships into formal legal entities to protect personal assets from being part of any lawsuit.

The actual details of an LLP depend on where you create it. In general, however, your personal assets as a partner are protected from legal action. Basically, the liability is limited in the sense that you may lose assets in the partnership, but not those outside of it (your personal assets). The partnership is the first target for any lawsuit, although a specific partner could be held liable if they personally did something wrong.

Section 8 Company

A Section 8 Company is a non-profit organization that aims to promote charitable activities, art, science, education, and sports. The profits of such companies are utilized for promoting these objectives and are not distributed among the Company’s members. It is essential to understand what is Section 8 company, document requirements, and company incorporation process.

we provide end-to-end services for registering Section 8 companies in India. Our team of experts offers hassle-free and professional services to help you establish a Section 8 company quickly and efficiently. Contact us today to avail of our professional services for registering your Section 8 Company in India.

What is Section 8 Company? – Companies Act, 2013

According to the Companies Act 2013, a Section 8 company is defined as an organization whose objectives are to promote arts, commerce, science, research, education, sports, charity, social welfare, religion, environmental protection, or other similar activities goals. These entities utilize their profits to achieve their mission and do not distribute dividends to their shareholders.

Overview of Section 8 Company Registration

A Section 8 Company is a type of corporation established to promote non-profit activities, such as education, social welfare, environment preservation, arts, sports, charity, and more. This follows the provisions of the Companies Act 2013.

The essential purpose of registering a Section 8 Company is to encourage non-profitable goals, including but not limited to trade, arts, commerce, education, charity, environmental protection, sports research, and social welfare. To register a Section 8 Company, a minimum of two directors are required, and there is no requirement for a minimum paid-up capital to set up such a company.

Key Points about Section 8 Company Act

- In India, Non-Governmental Organizations (NGOs) can be registered under the Registrar of Societies or as a non-profit entity under Section 8 Company of the Companies Act, 2013.

- Profit generated by Section 8 Companies cannot be used for purposes other than charitable objectives and cannot be distributed among shareholders.

- Section 8 Companies are similar to the erstwhile Section 25 Company under the Company Act 1956. As per the prevailing Company Act, these are now recognized as Section 8 Companies.

- Section 8 Companies are required to comply with the provisions of the Companies Act 2013. They are mandated to maintain books of accounts, file returns with the Registrar of Companies (ROCs), and comply with GST and IT Act.

- Any changes to the charter documents like the Articles of Association (AoA) and Memorandum of Association (MoA) require the government’s consent.

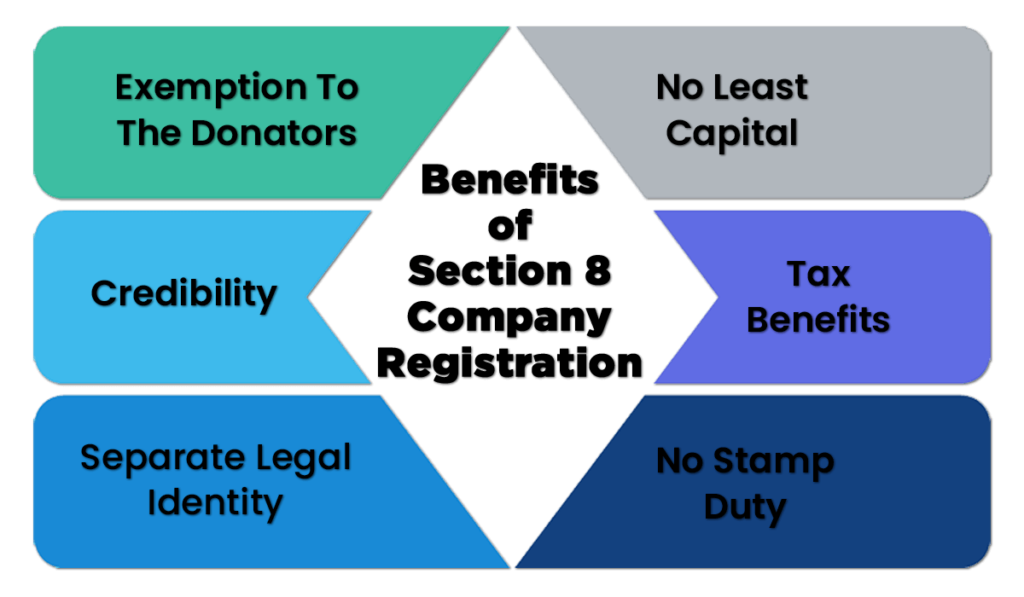

Benefits of Opening a Section 8 Company in India

Incorporating a Section 8 company in India offers numerous advantages, some highlighted below.

Tax Exemption

Section 8 companies registered under section 12AA of the Income Tax Act are eligible for a 100% tax exemption, as they utilize their profits for charitable purposes. This is a significant benefit as the profits generated by such entities are non-taxable.

No Minimum Capital Requirement

Unlike public limited companies, Section 8 entities do not have a minimum capital requirement. They can adjust their capital structure according to their growth, giving them more flexibility.

Separate Legal Entity

Section 8 companies have a separate legal identity and perpetual existence, just like other registered companies. This increases their credibility and provides them with more autonomy and legal standing.

Increased Credibility

Section 8 companies are subject to strict legal compliance frameworks, enhancing their credibility regarding legal standing. Unlike NGOs and trusts, Section 8 entities follow stringent compliances post-registration, making them more trustworthy.

No Title Required

Section 8 companies are free to choose a name that suits their liking during the registration process. Unlike other registered structures, they are not required to affix the term “Section 8” after their name.

A Section 8 company in India offers numerous benefits, including tax exemption, no minimum capital requirement, no need to pay stamp duty, separate legal identity, increased credibility, and no title required. These advantages make Section 8 companies attractive for entrepreneurs looking to start a business with a charitable or social cause.

Eligibility Criteria for Incorporation of the Section 8 Company

Specific eligibility criteria must be met to establish a Section 8 company in India.

- An Indian national or Hindu Undivided Family (HUF) can incorporate a Section 8 Company.

- The entity must have at least one director.

- The primary object of the Section 8 Company Act should be related to promoting art and science, sports, charitable activities, education, or providing financial assistance to individuals from lower-income groups.

These eligibility criteria ensure that the Section 8 Company operates to promote social welfare and contribute to the greater good of society.

PG Bansal and Associates offer seamless company registration services for Indian nationals seeking to establish their businesses in India. Whether you’re a first-time entrepreneur or expanding an existing business, our services ensure a smooth and compliant process to incorporate your company.